Gifts & Ticket Sales Revenue Analysis: US, Canada, and UK – August 2023

The month of August has come and gone, and it’s time for another in-depth look at the evolving markets of gifts and ticket sales in the US, Canada, and the UK. This installment adds another layer of complexity and intrigue to our ongoing study, particularly as dramatic variations emerge with continued challenges and surprising growth across the different regions.

Key Observations:

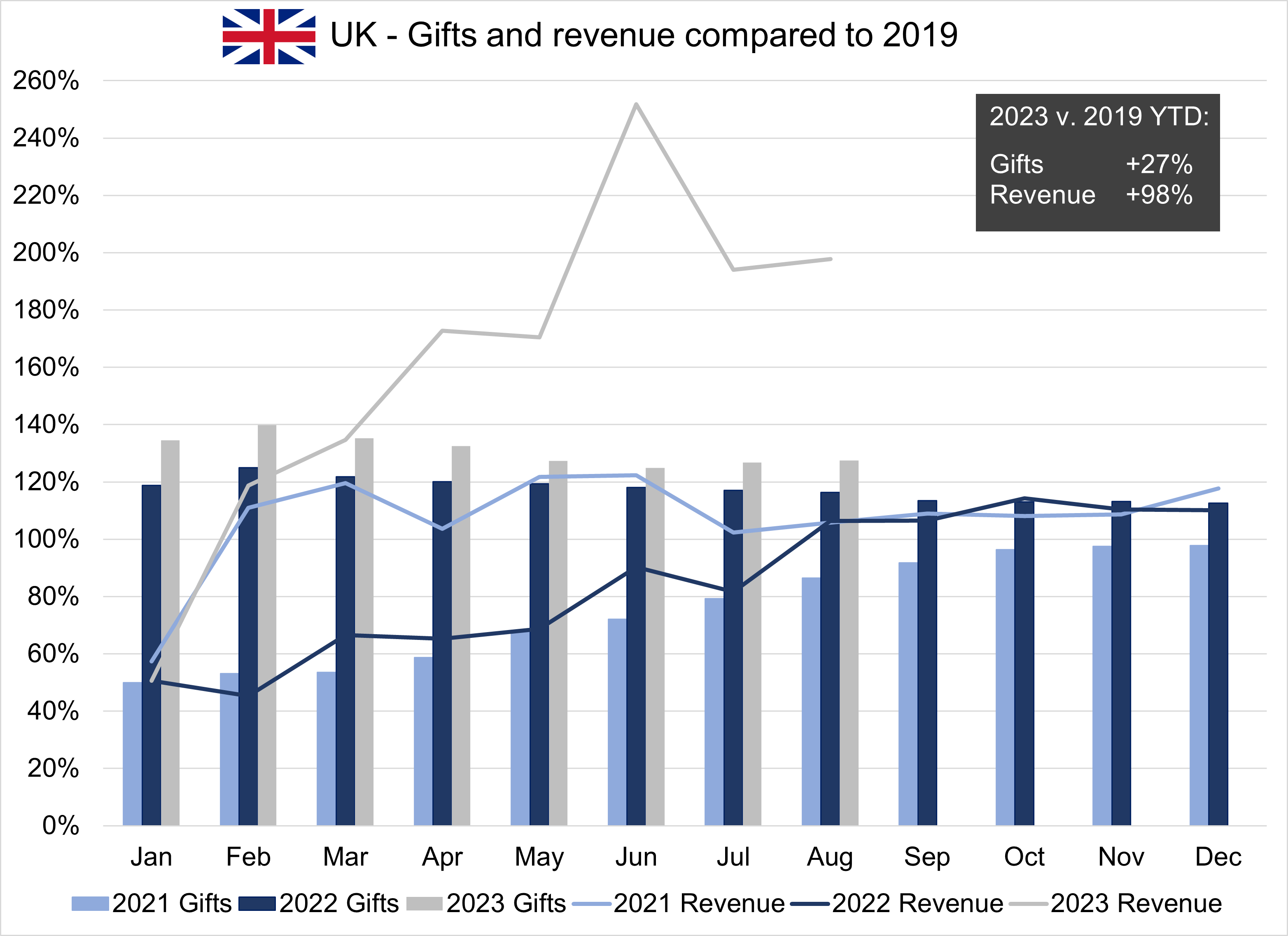

- UK’s Gift Surge: The evident augmentation in the UK’s gift segment necessitates further research. Are we observing a genuine increase in philanthropy, or are there structural changes in financial reporting by certain entities?

- US’s Revenue Chasm: The US’s YTD gap is not just numbers on a paper; it represents potential projects, jobs, and services that remain unrealized. Delving into the causative factors could uncover actionable insights.

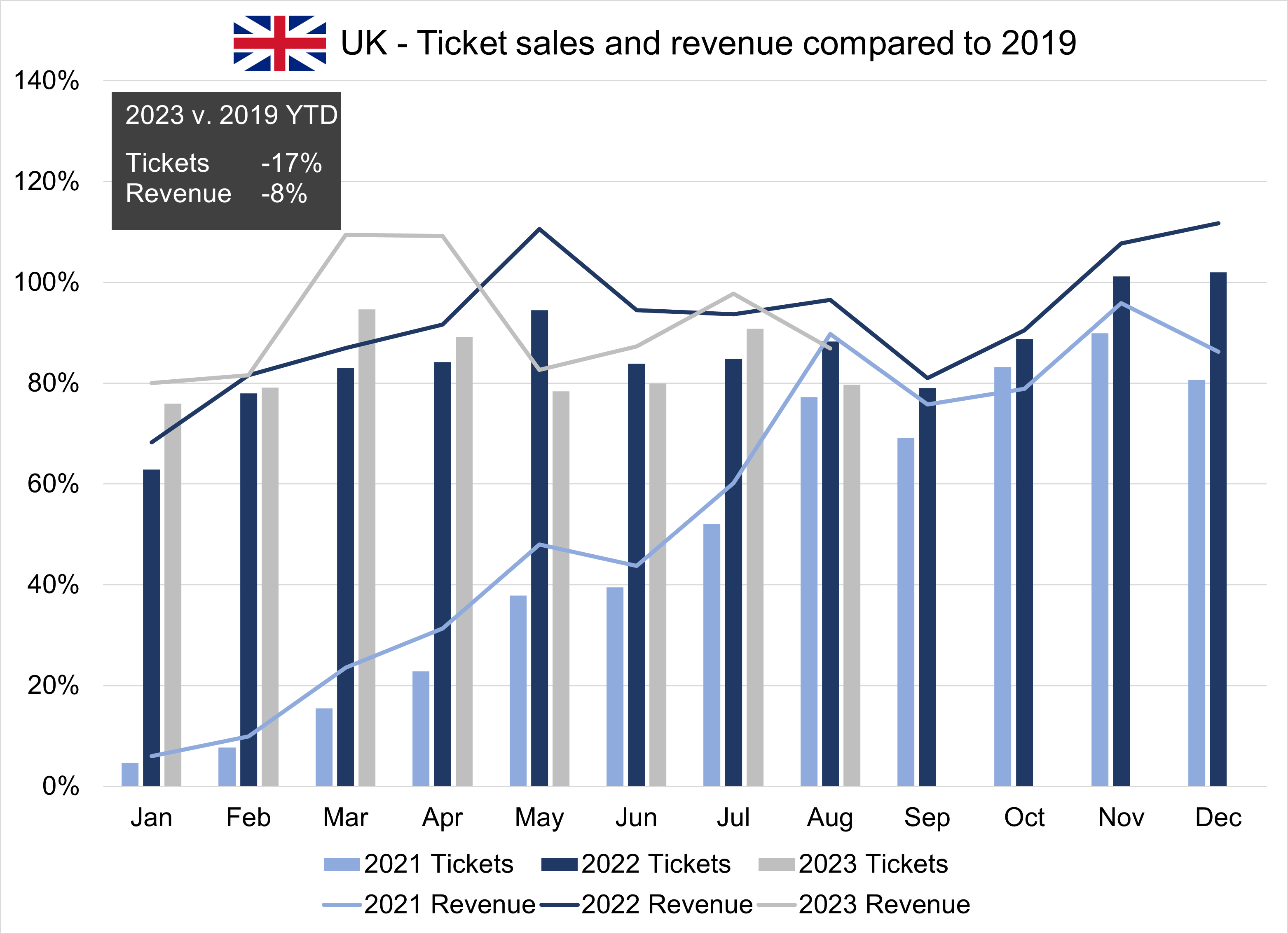

- Inflation’s Understated Impact: The UK’s ticket market brings to the forefront the necessity of understanding figures beyond their face value. Adjusted for inflation, seemingly positive or stagnant numbers might hide significant downturns.

US: A Growing Concern

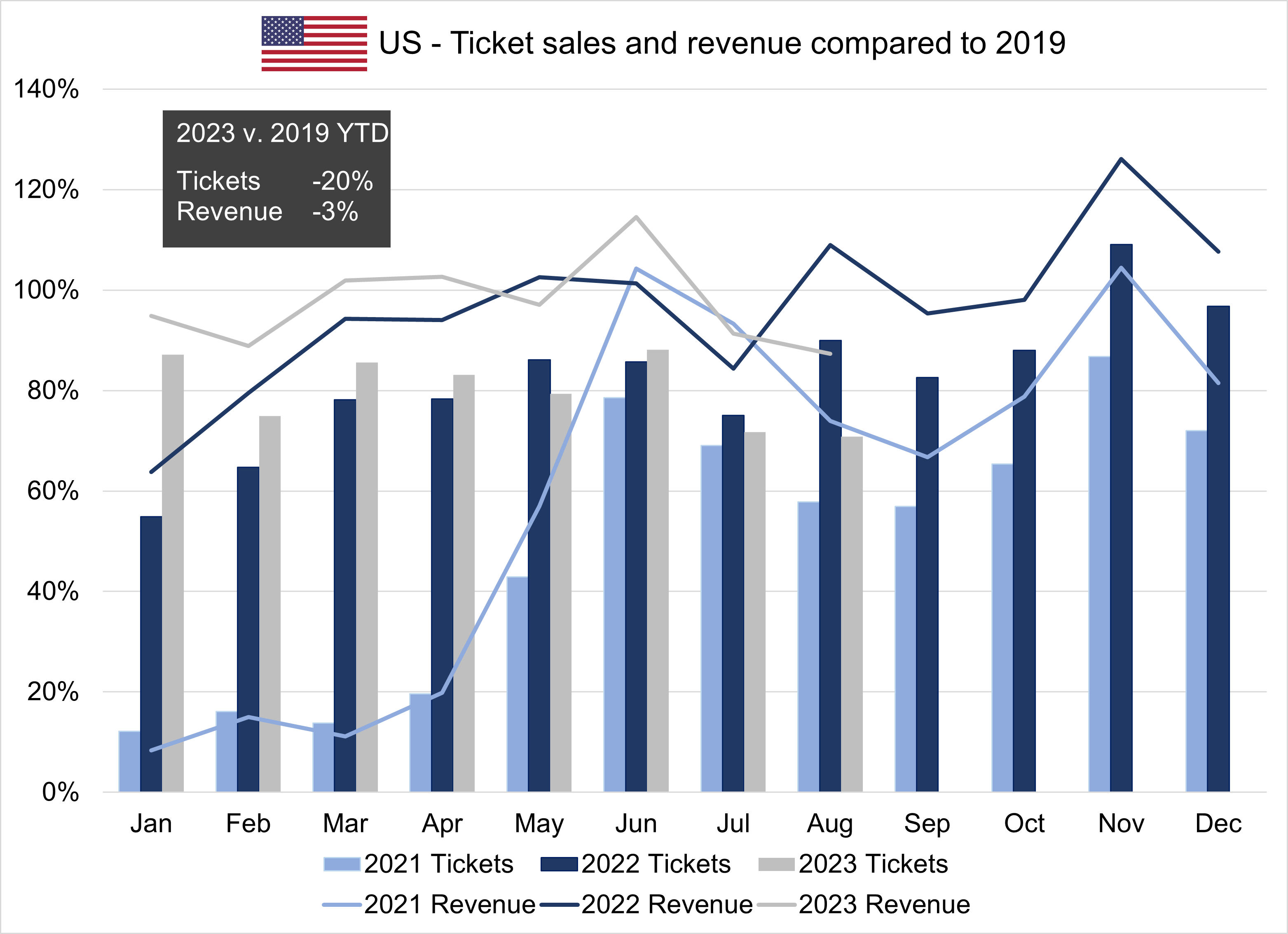

Ticket Market Woes Continue

August Analysis: There seems to be no reprieve for the US ticket market; August saw a continuation of the previous month’s weak ticket sales and revenue.

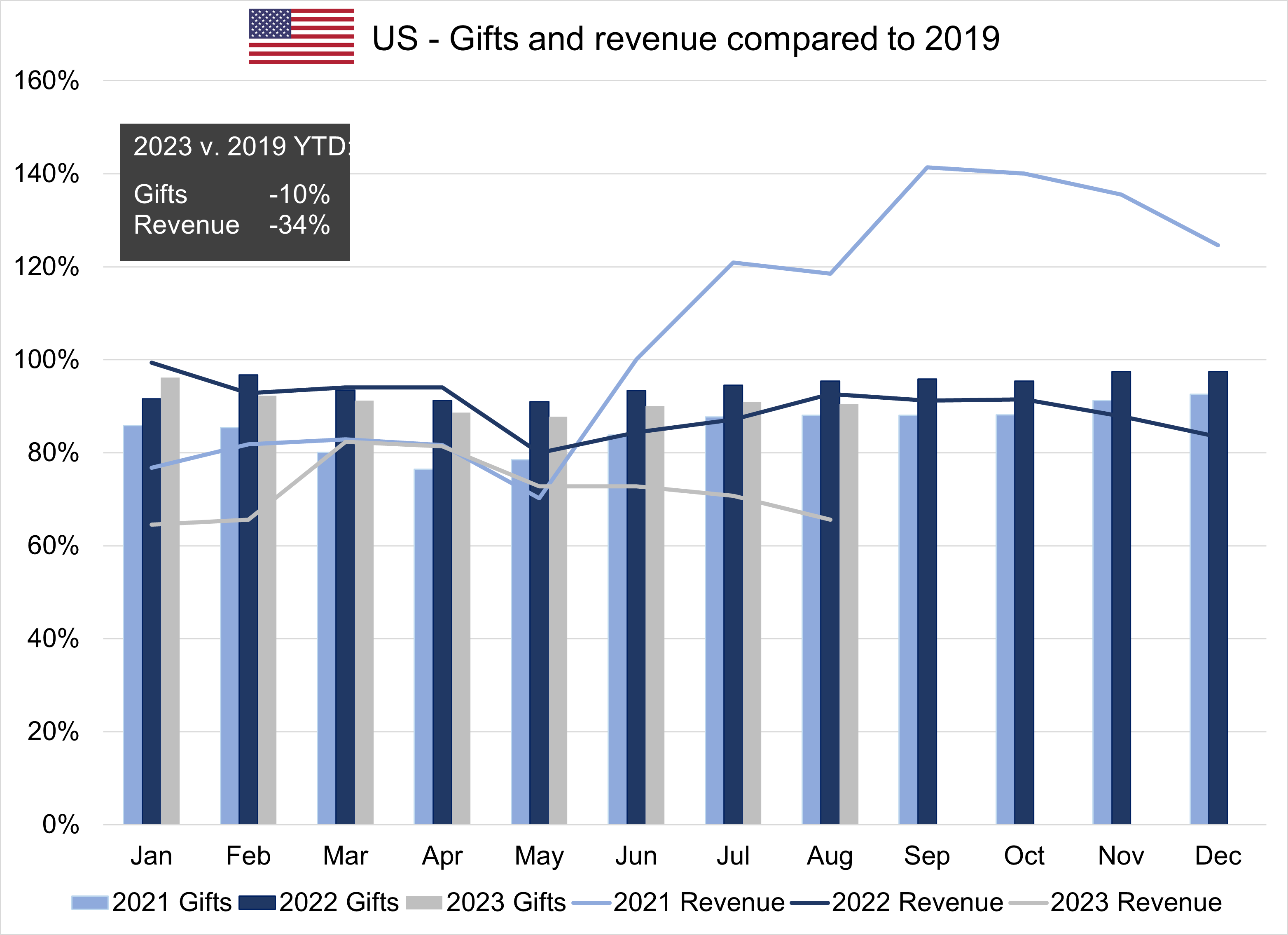

The Alarming Gap in Gift Revenue

August Analysis: Cumulative gift revenue for the year shows a glaring 34% decline compared to 2019, representing an aggregate $237 million gap in YTD revenues. This significant discrepancy could be a major story in itself that warrants deeper exploration.

Canada: A Glimmer Amidst the Gloom?

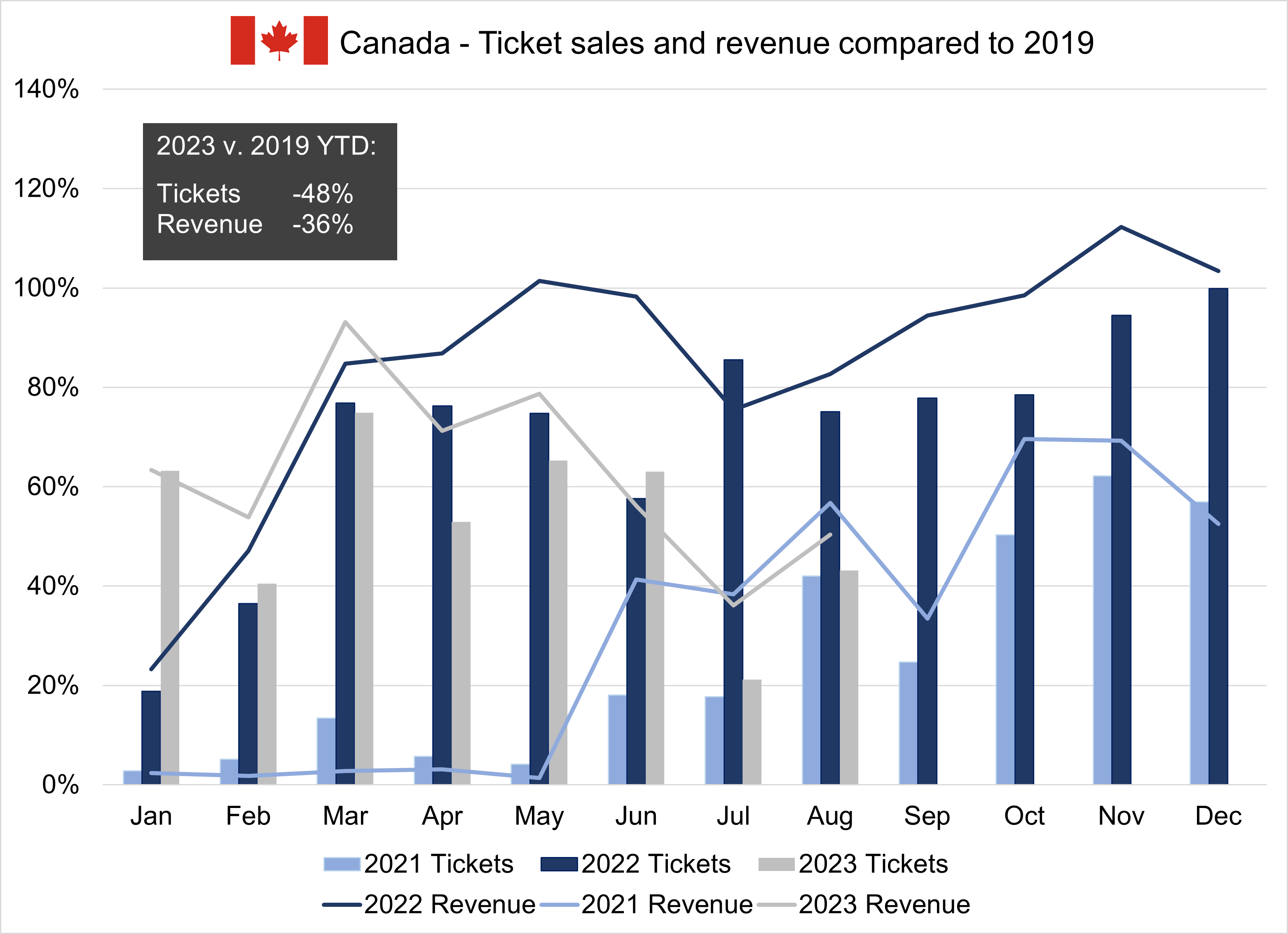

A Slight Respite in Ticket Sales

August Analysis: While still far from ideal, ticket sales in August were not as calamitous as in July. Nonetheless, the overall picture remains concerning.

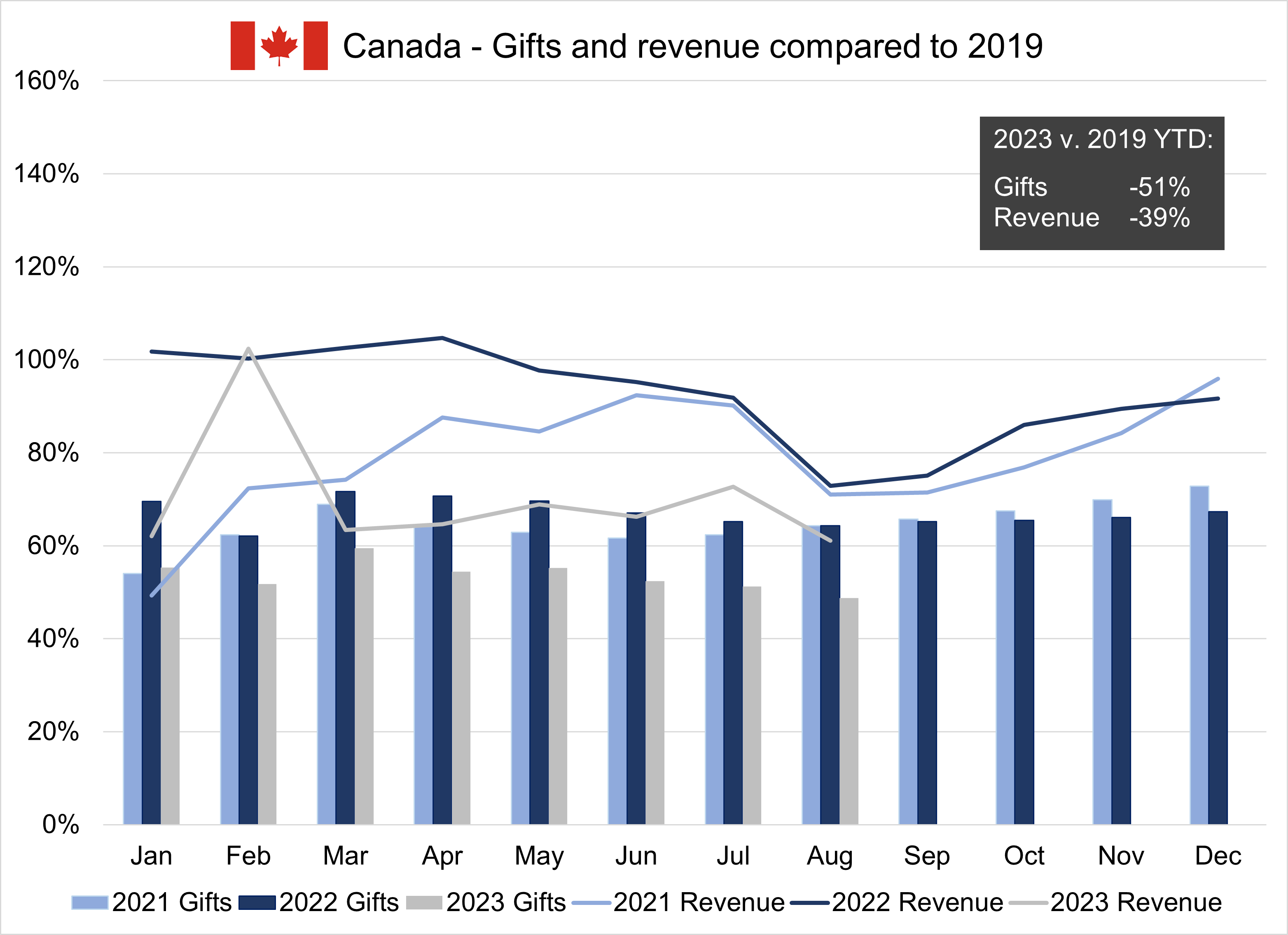

Gift Market Status

August Analysis: Despite slight improvements in ticket sales, the overarching sentiment still presents a challenging panorama for Canada.

UK: A Tale of Two Markets

Concerns in Ticket Sector

August Analysis: While there was a marginal 2-3% growth in ticket sales and revenue compared to 2022 YTD, this effectively translates into a substantial drop when accounting for inflation.

Gift Market Flourishes

August Analysis: A stunning increase of 27% in gift revenue compared to 2019 is observed. Upon further investigation, some of this surge appears to be driven by organizations including large capital grants and donations. The UK’s gift sector is undeniably the showstopper for August. Some interesting financial patterns have come to light; with certain organizations incorporating substantial capital grants/donations. Despite this potential skewing of figures, the 27% growth in comparison to 2019 is nothing short of phenomenal.

Conclusion: Diverging Narratives

August 2023 has been a fascinating month for gifts and ticket sales in our focus countries. The US continues to alarm with its significant loss in gift revenue and stagnant ticket market. Canada, although slightly better than July in ticket sales, is not out of the woods. On the other hand, the UK presents a compelling story with its remarkable gift revenue performance.

The UK’s gift market, in particular, stands out as an intriguing area for future investigation, possibly providing insights that could benefit other regions. But when it comes to ticket sales, the persistent lack of momentum across all three nations should be considered a red flag, warranting focused strategies for revival.

As the tale of these markets continues to unfold, continuous scrutiny and adaptive strategizing remain crucial for tapping into emerging opportunities and navigating challenge

.jpg)