First, let me say: I’ve been looking hard to find a sector harder hit by pandemic economics than live and in-person, mid-sized performing arts and cultural businesses. Many sectors were affected dramatically, too—think restaurants and travel—but I haven’t found one devastated like ours yet (so if you have data that I haven’t found, contact me here). Indeed, not all recoveries have been created equal. At TRG Arts, we’re a little obsessed with this reality. Part of that obsession is driven by our mission and values; part of it is driven by data reporting from our Arts and Culture Benchmark that our firm has been using to track the sector’s recovery since the beginning of the pandemic.

Recently, I was invited by American Theatre Magazine to share US theatre Benchmark stats relative to pre-pandemic times. This was the first time we formally reported on a specific arts genre within the performing arts sector, and we reported what we saw: by the end of 2022, US theatre company ticket revenues were still down by 35% compared to pre-pandemic 2019 and attendance was down by 33%.

This query got us curious. Until American Theatre asked us, “how is American theatre performing, specifically?”, we had reported only aggregate sector results, almost always by region. But by March of this year, the Benchmark has enough volume to be statistically reliable in a handful of major genres. So we dug further. And here’s what we found:

Not all performing arts recoveries are created equal.

Was this a surprise? It was startling in some ways. And confirming at the same time. At TRG Arts, we have clients in these genres, many of whom face the same opportunities and challenges as these numbers describe. We’ve been in board rooms, staff meetings and at conferences where the conversations behind these numbers take place.

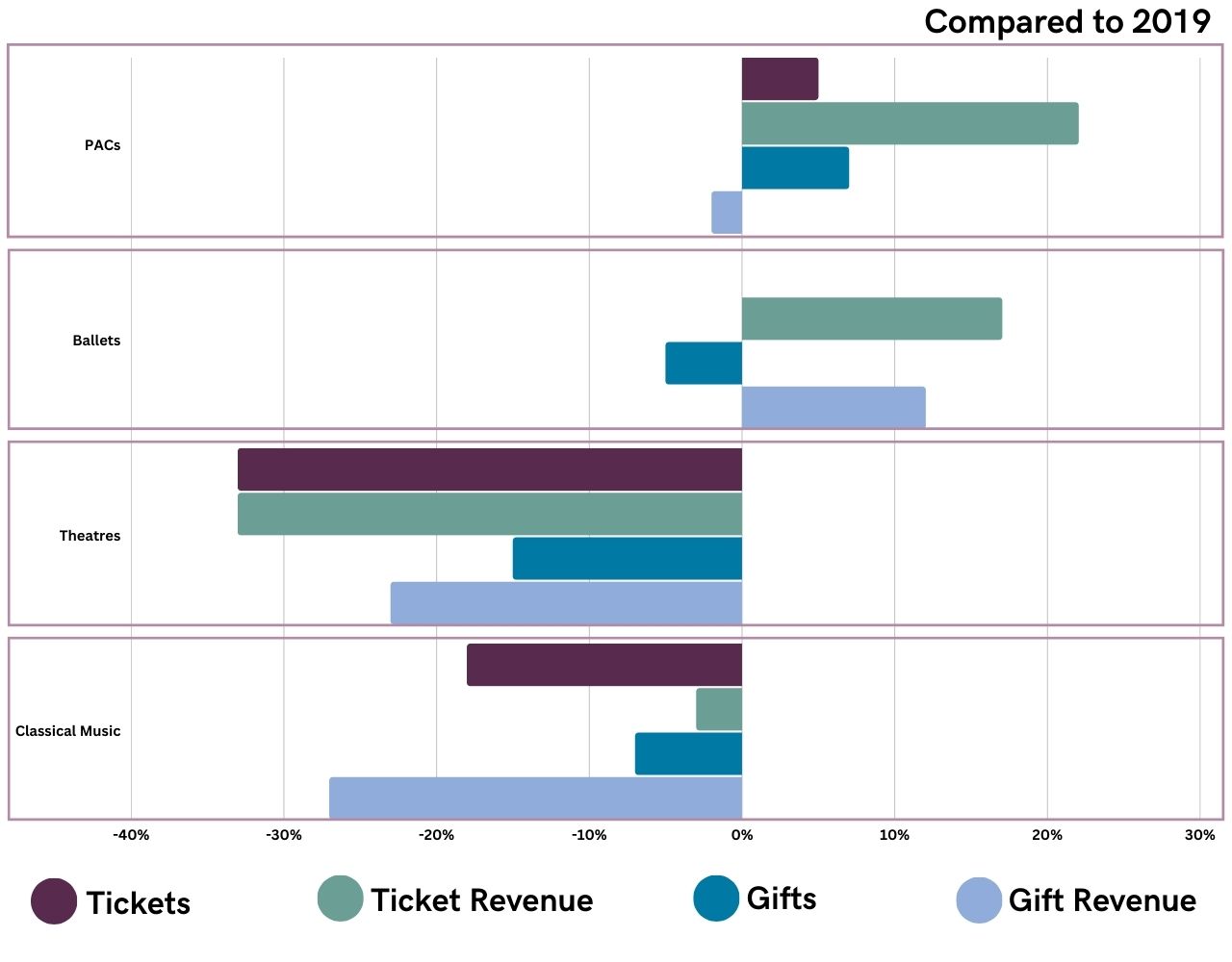

So here goes. We’d like to share what the Benchmark data says about four major categories of performing arts in the US, Canada and the UK: theatre, traditional ballet, classical music and performing arts centers, comparing the complete 2022 calendar year to the complete pre-pandemic 2019 calendar year.

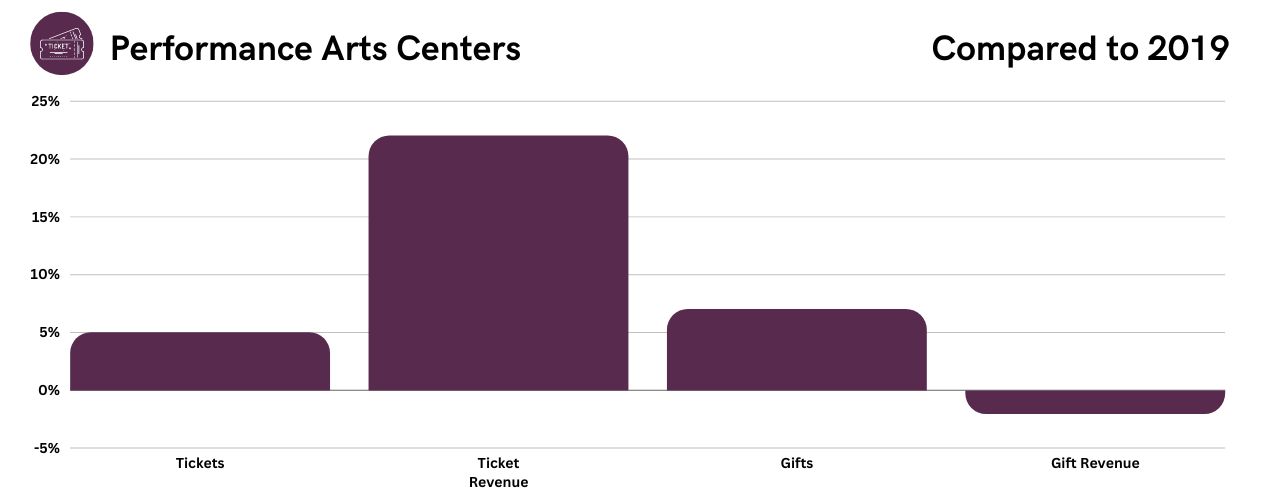

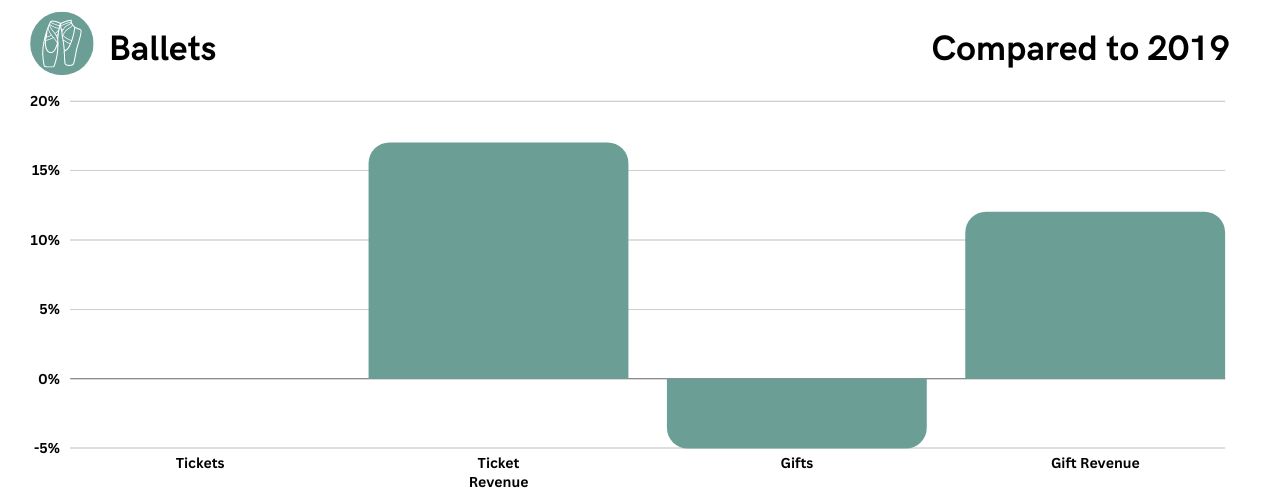

Finding #1: of the four genres, performing arts centers and ballet compete for the “most recovered” position by the end of 2022, in different ways. It seems possible that Performing Arts Center (PAC) early programming (and opening) flexibility drove that genre’s annual attendance and ticket revenue recovery. It also appears that while, like all arts donors, ballet company donors declined in their philanthropic support compared to 2021, ballet company donors supported their chosen art form more significantly compared to others through 2022.

The data:

By the end of 2022, PACs had experienced ticket revenue and attendance growth compared to 2019. Five percent growth in admissions; 22% growth in revenue. Philanthropically, the number of gifts had grown by 7%, but revenues were still down by 2% compared to 2019.By comparison, Ballet companies were up 17% in ticket revenue and flat in attendance compared to 2019. But: philanthropic revenue had grown 12% (the largest growth of any category) while the number of gifts was down 5%.

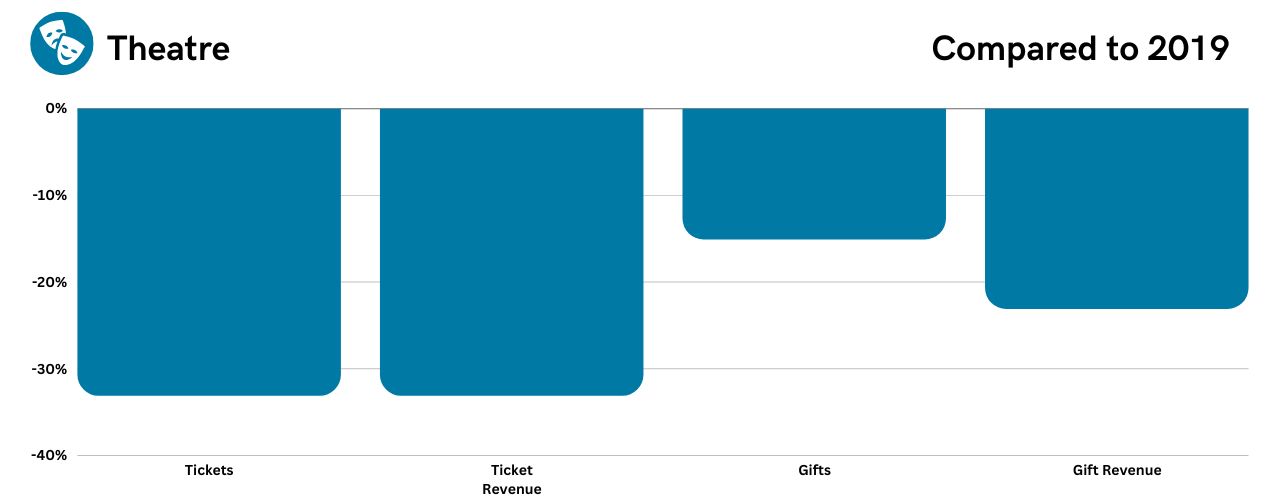

Finding #2: Theatre was the hardest-hit of the studied genres across all regions we studied. It’s been widely reported: theatre was buffeted by several variables, including typically smaller venues that couldn’t as easily open early in the pandemic (or enable large audiences if they did); safety precautions for unionized actors that limited live performance well into 2021; digital distribution challenges; and racial reconciliation in the US and Canada that informed changes to mission and programming and more.

The data:

Compared to 2019, theatre was down 33% in ticket revenues and admissions. Philanthropically, gifts were below 2019 levels by 15% and revenues by 23%.

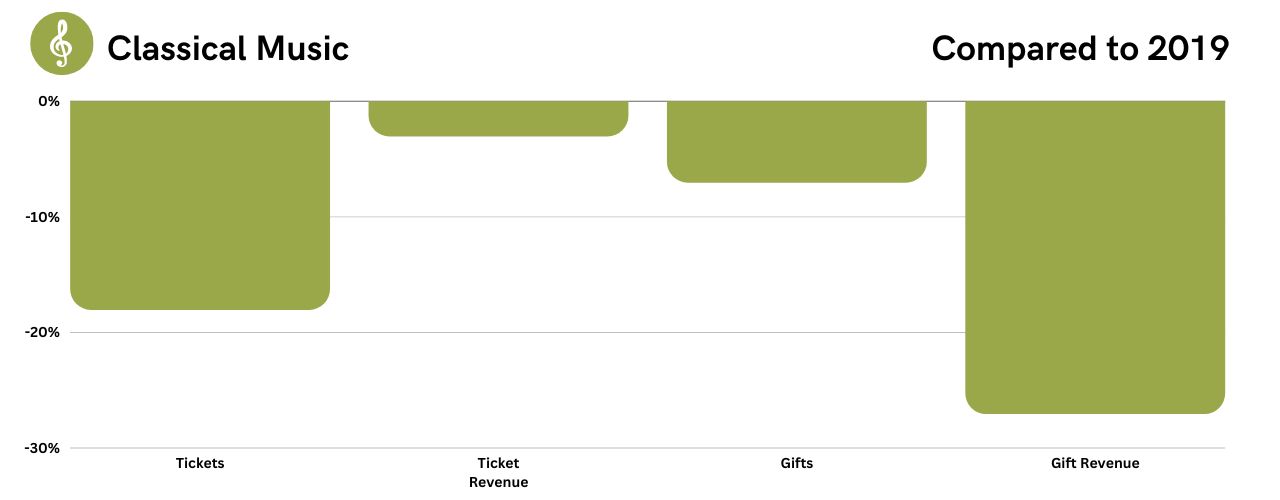

Finding #3: Classical music results fall in between the others. Classical music philanthropic giving is still considerably down compared to 2019, but ticket buying is heading more quickly toward recovery. TRG’s conversations and client results tell a story of a genre that had early pandemic digital distribution possibilities and the ability to present small ensembles that drove early in-person attendance in larger (read safer at a distance) venues.

The data:

By the end of 2022, Classical Music ticket revenues were down just 3%; admissions were still down 18%. Philanthropic income was still 27% lower than 2019 results; the number of gifts were down 7%.

The key “ah-hah!” from TRG’s point of view? Maintaining relationships with customers and donors, keeping their connections with the arts engaged and active—appears to be a key factor in driving organizational recovery from the pandemic. There were many creative ways this happened during the 2020-2022 period, from digital distribution to small ensemble performances to Zoom donor and ticket buyer gatherings to use of outdoor venues until going inside was permitted or felt safer. So many methods, so much creativity! And there’s no escaping the biggest reality: the sooner organizations could resume live performance and encourage customers to return, the sooner revenues and behaviors returned.

So, what does this mean for you, for your organization? What can you DO?

Plan aggressively for customer retention. As your organization re-builds, do NOT think short-term, but instead make every dollar spent on acquisition go further by investing in customer relationship building and retention. We don’t have time or money to waste now…every campaign must include follow-up, invitations for our customers to join us again, and more. Our previous bad habit of over-prospecting and under-retaining must stop. Programming decisions affect retention realities, too. We’ll be releasing new research on this topic for participants in our October 2023 Executive Convene, “Programming with Market Realities in Mind”.

Stop assuming. As current customers have aged out or changed habits, rebuilding our customer base will require inviting new members of our community to consider the arts. Add to this reality the fact that by 2040 community demographics will be wildly more diverse than today. The result? Arts organizations will need to become expert at asking and listening, rather than assuming and telling. The art of the conversation with our customers—we’re going to need to get much better at it.

Get real about the costs, financial and human, of rebuilding. Our creative sector must have and deserves talented, invested in and trained staff who deploy efforts designed to help the arts thrive in communities. Our governments, foundations, funders and stakeholders must make investments that help our sector yield long-term revenues and relationships.

Not all recoveries are created equal. But your organization’s commitment to regrowth will have an impact. I’ve said it before: hope is what we feel when we’re invested in the outcome and we know that there is still work to do.

We’re all invested; let’s be hope-filled and get to it!