Last week I introduced you to Paul Chambers, SUBTA, and SubSummit in Dallas. Celebrating and sharing the success of the $2 trillion recurring revenue industry, Paul started the SubSummit conference because, “…we were running a subscription box company from 2014 to 2020 called The Gentlemen’s Box, and we wanted to meet other subscription box companies and assumed there was a conference…it didn’t exist!” he told me during a recent conversation.

So, he started it. And five years later, it’s the largest global conference of its kind focused on the recurring revenue industry, attracting the likes of Amazon, Walmart, Netflix, The New York Times, and many more. “We’re champions for the businesses that are in this space, and we’re total geeks about it.” Last year SUBTA published this annual report about the recurring revenue industry that includes predictions for 2024. Their new report will be coming out soon, and in my next blog we’ll look at a sneak preview. There’s much to learn about best practices in acquisition, retention, pricing, and more. In the meantime, let’s take a look at some of the building blocks.

As I previously described, there are six categories of recurring revenue mechanisms that SUBTA has identified, and I asked you to describe if you see these as active categories and programs in arts and culture. You voted, and said these three are the ones you see today:

-

Subscribe & Save: customers receive both a one-time purchase option and the option to subscribe to a specific product and receive it weekly, monthly, quarterly, etc., in a specific quantity. The subscription comes with a discount per unit so customers are incentivized to subscribe.

-

Membership: customers pay a recurring fee to access the value the business creates, and the business provides a specific design for different Membership levels.

-

Streaming (video/music): providers offer on-demand and live viewing/listening across a variety of devices and platforms.

At TRG Arts we’ve seen it in our clients’ and aggregated data since the beginning of our firm’s history, and regularly tell the story in this simple table based on a real performing arts organization’s data:

We see these options, at TRG Arts too. Arts and cultural businesses have been experimenting with recurring revenue models for some time. It’s surprising because I observe the conversation most often, only, being about THE SUBSCRIPTION. But as you’ll see below, we’ve tested and learned about a lot of models in our sector.

Over our nearly 30-year consulting history, TRG Arts consultants have helped develop a half-dozen recurring revenue mechanisms for arts and cultural businesses in many countries. In each case, the customers who choose these options exhibit behavior that is more recent, frequent, and monetarily invested than one-time buyers/visitors, which helps create the sticky, recurring revenue that our sector so desperately needs now. These customers are not all the same, though! We’ll get to that in a minute.

Let’s first look at the mechanisms we’re familiar with at TRG Arts:

1.Seated subscription/season ticket - This option enables the customer to choose specific events that are preferred, while seating is most often variable and changes on a per-event basis. Seats are assigned in advance. Annual fee, package (not seats) renewal. There is typically a variation in the number of events able to be packaged, with deeper savings rewarded as event volume grows within the package. Subscribe & Save.

2.Choose Your Own subscription/season ticket - We’re all familiar with this packaging option, which is also found as a successful model in commercial and college sports. There is wide variation in the volume of events and pricing included in packages; deeper savings are provided as package size grows. Annually renewable seats/fee. For premium prices (and often based on loyalty status), options often include access to priority seating inventory and services. Events are pre-packaged and selected for the consumer in advance, as are seats. Subscribe & Save.

3. FlexPass/Vouchers - Sold as a “book” of vouchers or coupons that can be redeemed for one or multiple events at one time. Smaller discounts are provided compared to packages above; customers trade deeper discounts and preferential seating for flexibility and advance seat assignments, which are made at point of redemption during priority redemption windows. Rolling renewal as passbook is utilized. Subscribe & Save.

4. Monthly Access Membership - Monthly fee, auto-charged charged on rolling basis until cancelled or customer credit defaults/changes. Membership provides unlimited access to events/exhibits/collections; often priority events or exhibits are excluded from membership (access at additional charge). For events, seats are assigned at time of redemption and often in-demand sections are excluded from access (access at additional charge). Membership

5. Annual “Club” Membership - Annually renewed program based on variety of programmatic, demographic, geographic (and more) variables, pre-designed and determined by the business. Typically includes tickets and associated club educational/social events. Membership

6. Annual “Club” Membership - Points-based Rewards Membership. Points accumulated with each admission or ticket purchase, redeemable for free tickets and other goods (merchandise, food & beverage). Deadlines for redemption to mitigate business balance sheet risk. Membership

Additionally, the performing arts field has experimented with streaming services, of sorts. From The National Theatre to The Cleveland Orchestra and The Metropolitan Opera, big and small performing arts businesses have experimented or were forced (during the pandemic) to experiment with digital distribution and some of it has stuck. Revenue and expense realities are being reconciled now, but here’s what’s clear: digital is here. The sooner we figure it out in a way that works from a business perspective, but larger the portfolio of recurring revenue and customer options we’ll have.

Have you seen other options than these? Tell me about them here!

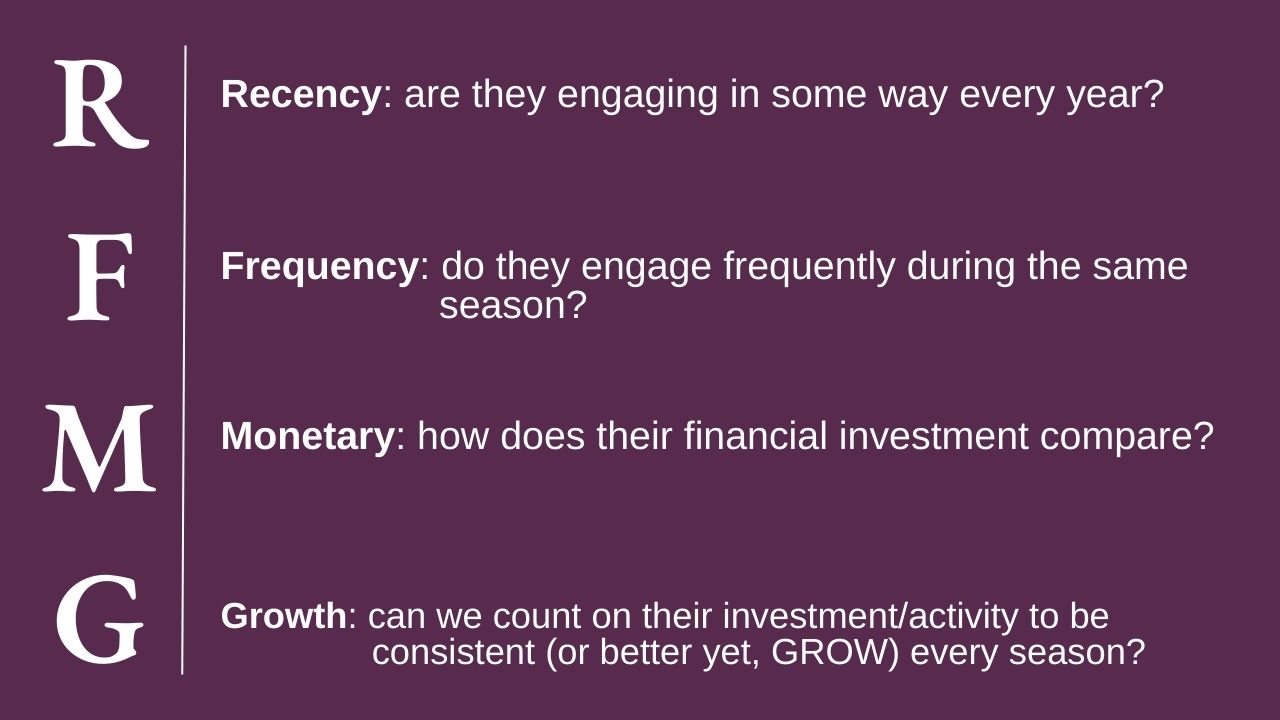

These customers are not all the same. The customers who purchase these options are quite different in their behavior and recurring revenue strength across programs. But they’re ALL stickier and their net revenues more powerful than the one-time visitor/ticket buyer. We simplify the differences down to RFMG:

How, as a group of customers by package/program:

- Recent is the customer behavior? Renewal rate is a great metric to measure recency. The higher the monthly or annual renewal rate, the stronger the revenue “stick”.

- Frequently does this group of customers behave? A 10-concert subscriber who uses their tickets has a higher frequency or participation rate than a customer who purchases an annual membership but never gets to the museum or theater. Regular participation correlates to sticky revenues, too.

- Financially invested (monetary) is this group of customers? Generally, the more invested a customer is, the stickier their behavior. Think annually for this metric.

- Finally, which group of customers has the highest annual growth rates? By program, which customers renew and increase their commitment year-on-year?

This RFMG math is the definition of recurring revenues that will drive your economic recovery and strength. Why? Because the larger the proportion of households in your organization’s customer database that are growing RFMG, the larger the proportion of “sticky” and depend-on-able revenue streams your organization will have…and at a MUCH lower cost structure than one-time visitors or ticket buyers. Higher net revenue means more income that hits the bottom line of your organization and funds the cool stuff you want to do now and in the future.

In my next and final blog, I’ll go deeper. About how recurring revenues can help the arts and cultural field now, and what we can learn from businesses outside arts and culture to accelerate them.

Jill S. Robinson

CEO and Owner, TRG Arts

.jpg)