Optimism for 2020 Arts and Culture Comeback Waning

TRG Arts published its findings to an initial study of 74 clients’ performance return plans in June 2020. The findings from that report can be found here. An update to that study, expanded to 133 arts and culture organizations across three countries indicates waning optimism for an autumn return to in-person live performances and a formal turn to paid digital programming after shutdowns caused by the global COVID-19 pandemic.

The study was refreshed and expanded on July 27, 2020, and represents organizations’ current scenario plans for returning to in-person paid performance, as well as those same organization’s plans for offering paid digital programming. Responses reflect arts and culture organizations across all disciplines of arts and culture in the United States, Canada and the United Kingdom.

The study does not contemplate how client organizations will operationalize live in-person performances. TRG has learned the delivery method and specifics for returning to in-person performance are highly variable, and rely on national and local guidance.

Regional Outlooks Reflect Level of Viral Containment

As a record number of Americans test positive for COVID-19, optimism for a 2020 in-person return to performances is waning for U.S. arts and culture leaders. The July study reveals 41% of U.S. organizations expect to perform to in-person audiences in 2020, compared to 61% in the initial June study.

Positive containment and infection reduction in the U.K. and Canada reveal slightly more optimism for a 2020 in-person return to performances, as described in Table 1.

Table 1: Organizations Planning 2020 In-Person Performances, by Region

| Organization Country |

% Expecting 2020

In-Person Performances, June study |

% Expecting 2020

In-Person Performances, July study |

|---|---|---|

| Canada | 44% | 50% |

| United Kingdom | 50% | 64% |

| United States | 61% | 41% |

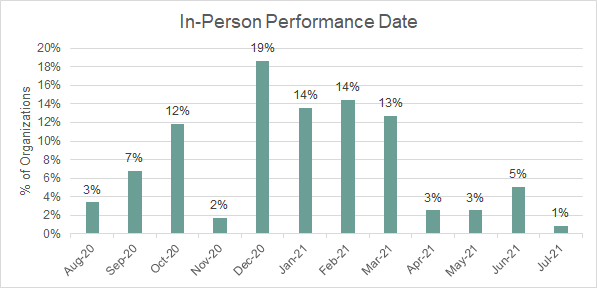

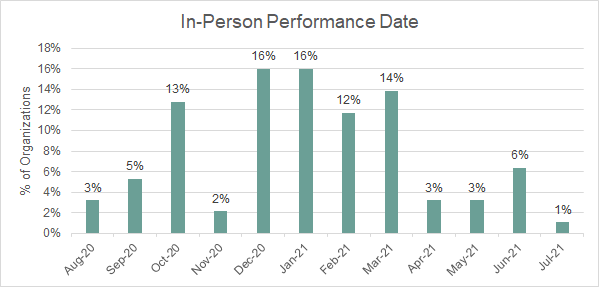

While 7% of clients have moved their in-person performance plans earlier in the calendar, a majority (54%) have delayed further in-person performances, on average two additional months. One-third of clients have not changed the dates of their expected return to in-person performances.

Across the entire study, 42% of organizations plan in-person performances resuming between August and December 2020, with 28% planning a traditional September season start. Of those planning a return in 2020, 44% plan to wait until December to perform, up from 19% in the initial June study. 11% of U.S. organizations expect to perform by September, while 41% plan to perform in-person by December.

Table 2: Organizations Planning 2020 In-Person Performances, by Genre

| Performance Genre | % Expecting 2020 In-Person Performances |

|---|---|

| Cinema | 0% |

| Dance | 71% |

| Multi-disciplinary | 75% |

| Opera | 0% |

| Orchestra | 38% |

| Presenter | 40% |

| Theater | 43% |

| Other Music | 0% |

Chart 1a: In-Person Performance Plans – All genres, all regions

Chart 1b: In-Person Performance Plans – All genres, U.S. organizations

Shifting Patterns of Optimism in U.S.

One of the most surprising findings in the initial Comeback study is that regions hardest and earliest impacted by COVID-19 and the resulting shutdowns, were among the most optimistic for an autumn return. The July study reflects decreasing confidence in the Northeast and Western states for a 2020 return to in-person performances. More than 55% of organizations in the Southeast and South expect to perform in 2020.

Table 3: U.S. client return expectations in 2020, by region

| U.S. Client Region |

% Expecting 2020

In-Person Performances, June study |

% Expecting 2020

In-Person Performances, July study |

|---|---|---|

| South | 100% | 100% |

| Southeast | 75% | 55% |

| Northeast | 71% | 41% |

| West | 55% | 32% |

| Midwest | 38% | 36% |

Continued Reliance on In-Person over Digital

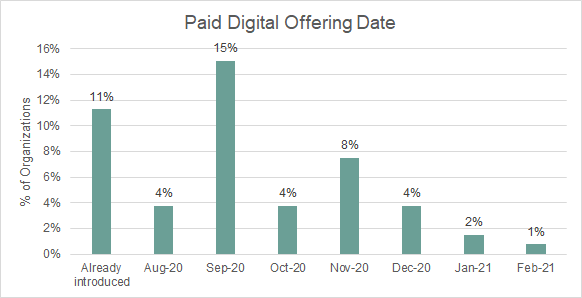

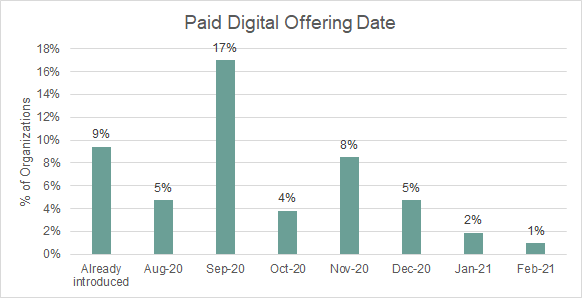

New in the July Comeback study are organizational responses to when paid digital content will be introduced to offset revenue losses from the cancellation of in-person performances. Only 36% of organizations plan to offer paid digital content in 2020, a majority of which plan to introduce paid digital content in advance of paid in-person performances.

52% of participating organizations do not have plans to offer paid digital content within the next 12 months.

Half of Canadian organizations plan to introduce paid digital programming, while 51% of U.S. and 20% of U.K. organizations articulated an initiation date for paid digital engagement.

Table 4: Paid digital engagement plans in next 12 months

| Timing of Paid Digital Engagement | % Organizations |

|---|---|

| Introduced before paid in-person performances | 29% |

| Introduced in same month as paid in-person performances | 4% |

| Introduced after paid in-person performances resume | 3% |

| No plans for paid digital engagement | 63% |

Chart 2a: Paid Digital Plans – All genres, all regions

Chart 2b: Paid Digital Plans – All genres, U.S. organizations

Ongoing Evaluation

TRG Arts is continually studying the impact of COVID-19 on the resiliency of the arts and culture field, and has made several resources free and available to all.

COVID-19 International Sector Benchmark studies live transactional data from across the globe. It allows participants to compare their patron purchase trends to geographic-specific benchmarks and is intended to be used for arts advocacy and planning. Participating organizations can learn how their recovery compares to other similar organizations.

Participation is freeTRG 30 is a weekly 30-minute collection of provocative conversations with leaders in the field of arts and culture as well as adjacent industries; its goal is to inspire arts leaders to evolve institutions to become more resilient upon their return to “normal” operations.

Sign-up is free