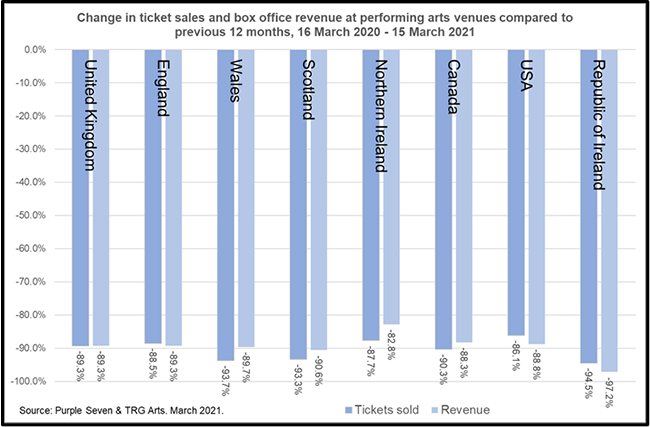

New box office data from the 12 months since March 16, 2020 when performing arts organizations shut down show the catastrophic impact of the pandemic in the U.S., Canada, the U.K. and the Republic of Ireland. In analysis released today, international arts management consultants TRG Arts and UK arts data specialists Purple Seven report that despite periods of live public performances during the year in some regions and a rapid growth in ticketed digital performances, in the U.S. year-over-year ticket sales were down 86.1% and box office revenue was down 88.8%, and in the UK, ticket sales fell 88.5% and box office revenue was down 89%. Across the international study group, year-over-year ticket sales fell 88.5% and box office revenue was down 89%.

| Tickets Sold | ||

|---|---|---|

| Canada | -90.3% | -88.3% |

| United States | -86.1% | -88.8% |

| Republic of Ireland | -94.5% | -97.2% |

| United Kingdom | -89.3% | -89.3% |

| England | -88.5% | -89.3% |

| Northern Ireland | -87.7% | -82.8% |

| Scotland | -93.3% | -90.6% |

| Wales | -93.7% | -89.7% |

Change in Ticket Sales and Box Office Revenue at Performing Arts Venues Compared to Previous 12 Months, 16 March 2020 - 15 March 2021:

The data from 349 performing arts organizations (94 in the U.S., 12 in Canada, 226 in the U.K., and 17 from the Republic of Ireland) come from the COVID-19 Sector Benchmark, an initiative led by TRG Arts and Purple Seven, which has grown into the largest global arts and cultural consumer dataset in the industry. It captures near real-time data from box office feeds of all scales. The majority of the sample are theaters, but there is also a representation of arts centers and orchestras.

Over the past 12 months performing arts organizations have reacted and adapted to unprecedented circumstances at incredible speed. This time has shown us that digital channels can play a role in our quest for patron engagement. However, to be sustained by a blend of live and digital channels in the future, we must learn from the innovative organizations that have deepened patron relationships and developed meaningful revenue from their on-line audiences in the last year.

The COVID-19 Sector Benchmark tracks sales on a daily basis from the box offices of arts organizations. These could be for live in-person performances, live streaming or access to on-demand content.

“Over the past year many tickets have been sold to performances that were then postponed or cancelled,” explained Purple Seven Managing Director David Brownlee. “This means that the true impact of COVID-19 has been even worse than the stark figures we are reporting today. One bright spot we noted in the data was a noticeable uplift in sales in the U.K. in November and December 2020. Sadly, many of these sales would have been for performances that were then postponed or cancelled due to local and then national lockdowns, but it does highlight that there is demand from the public to return to live performances.”

The best U.K. arts fundraisers take the same approach as their North American colleagues in focusing on long term relationships where supporters understand and value what the organization is delivering for its community.”

David Brownlee, Managing Director, Purple Seven

About the COVID-19 Benchmark Dashboard

Purple Seven and TRG Arts continue to offer free access to the free COVID-19 Benchmark Dashboard to organizations in the U.S., Canada, the U.K. and the Republic of Ireland. Register here.

Expansion of the COVID-19 Benchmark Dashboard is supported in part by a grant from the National Endowment for the Arts to SMU DataArts, a national center for arts research and TRG Arts’ long-time partner in advancing the arts and culture sector.

TRG 30 is a bi-weekly 30-minute series of conversations and provocations with CEO Jill Robinson and invited guests. Open to anyone in the arts and cultural sector, the sessions provide insight, counsel and inspiration.

Register Today