Gifts & Ticket Sales Revenue Analysis: US, Canada, and UK – November 2023

In November’s Gifts Ticket Sales Analysis, we extend our focus on the 2023 data, comparing it not only to 2019 to gauge recovery but also examining how it aligns with the patterns observed in the recent years of 2021 and 2022. The most intriguing findings from this report center around the continued strength of UK philanthropic activities and November in the US marking the high water point in total gifts, but revenues still not surpassing previous years.

Key Observations:

- Gifts: US best number of gifts all year, but revenue well down on previous Novembers. Canada still very concerning, UK still extremely positive

- Sales: US showing a bit of a revival, UK still very poor, Canada especially poor.

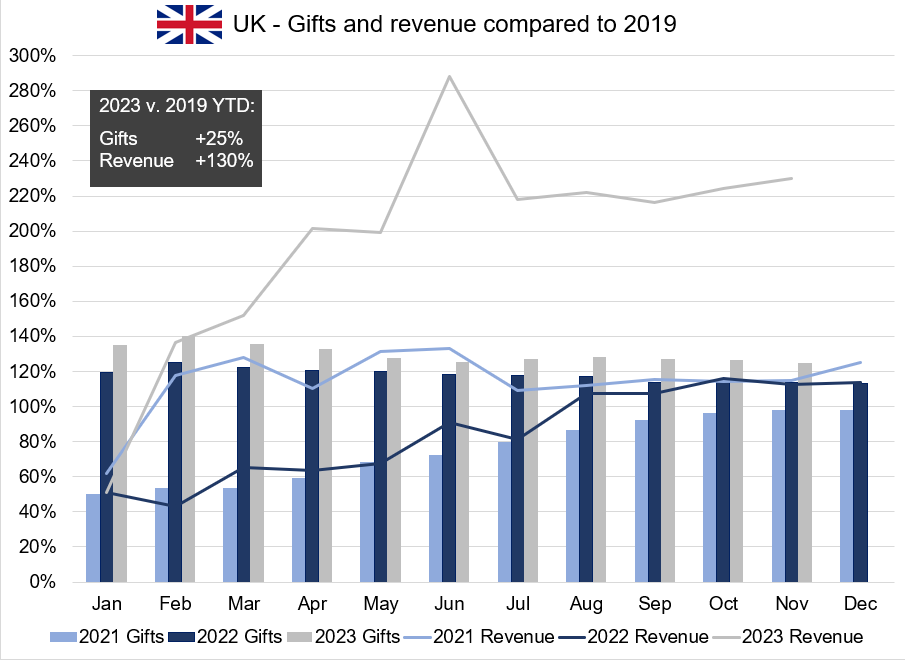

United Kingdom: Strong in Philanthropy, Modest Decline in Ticket Sales:

Philanthropic Gifts: Up 25% over 2019; Revenues up 130%.

The UK stands out with a substantial increase in both gifts and revenues over 2019. The revenue growth has not only surpassed the figures from 2021 and 2022 but also maintained a stable trajectory since July after peaking in June. This boom, particularly evident since February 2023, reflects a robust recovery and a potentially growing culture of philanthropy in the UK.

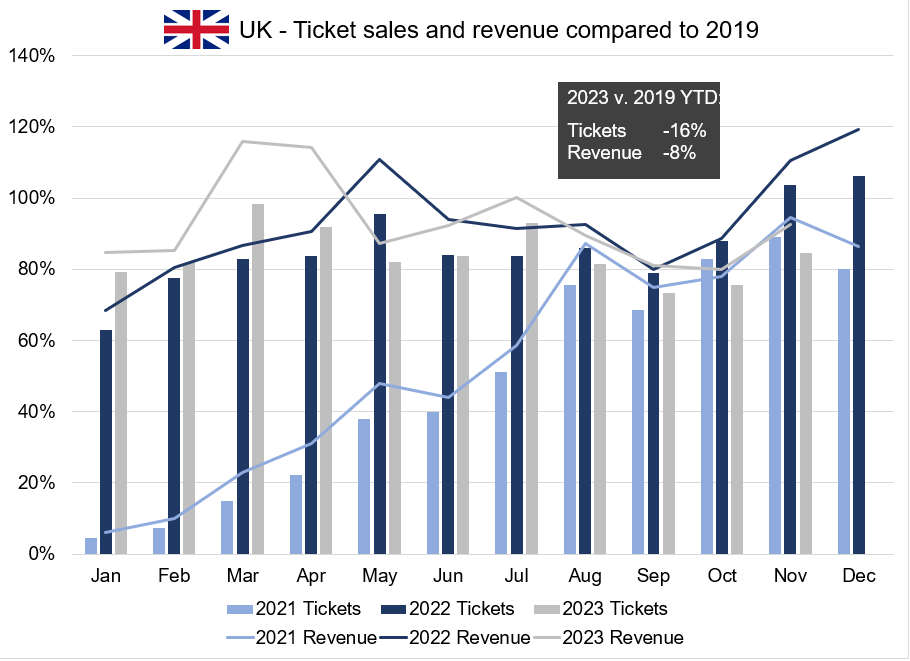

Ticket Sales: Down 16% from 2019; Revenues down 8%.

The UK’s philanthropic sector shows remarkable growth, but ticket sales have not maintained the same momentum. Despite a strong spring, ticket sales and revenues are modestly down from 2019. This indicates a possible shift in consumer preferences or spending patterns post-pandemic.

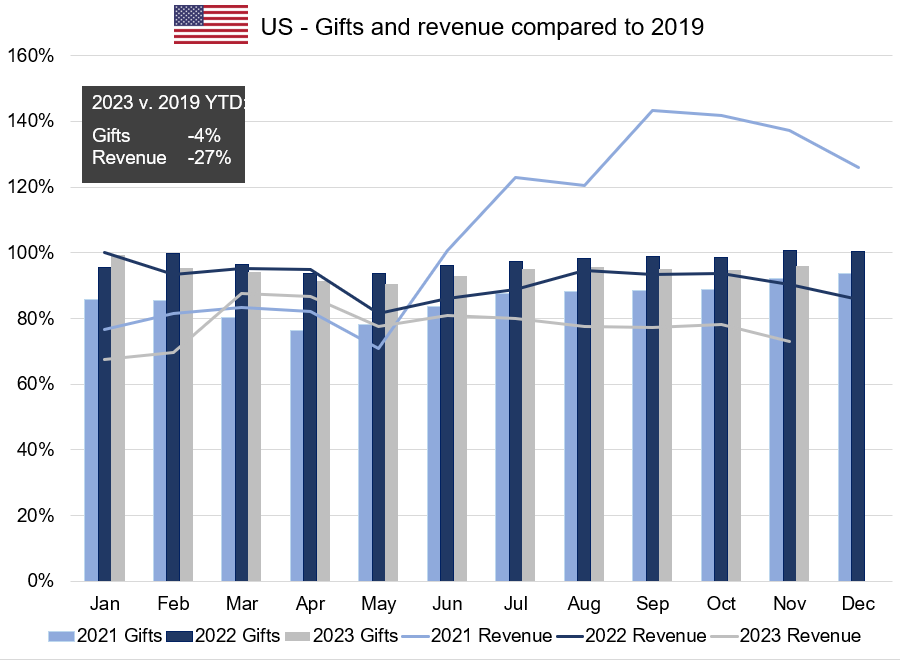

United States: Mixed Recovery in Philanthropic Gifts and Ticket Sales:

Philanthropic Gifts: Down 4% from 2019; Revenues down 27%.

The US shows a promising near-recovery in the number of gifts from the last strong year pre-pandemic. However, the revenue figures tell a different story, with a 27% drop from 2019. The year 2023 started with rising revenues but has seen a gradual decline since June, indicating a complex interplay of factors affecting donor behavior and spending capacity.

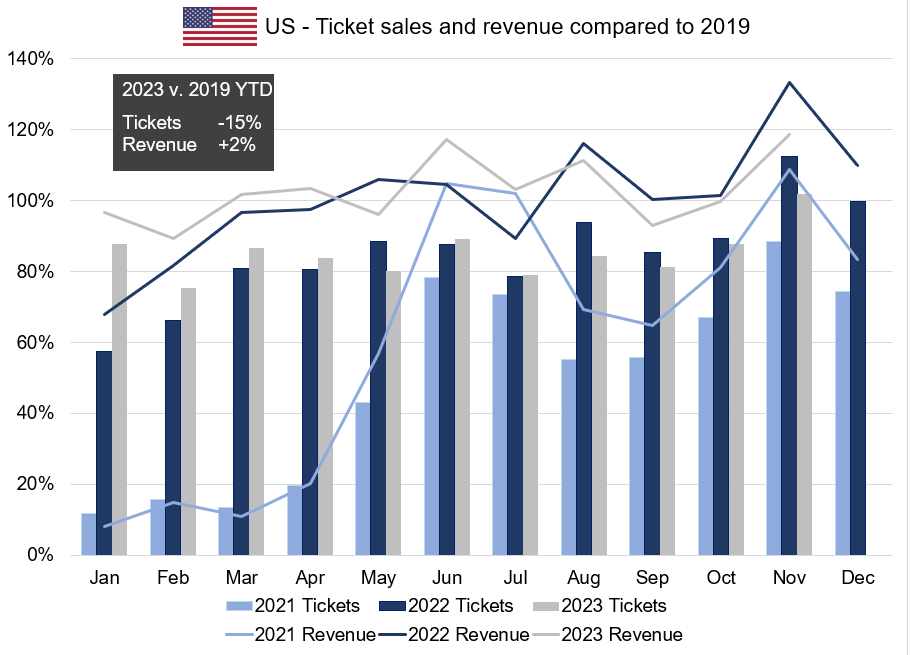

Ticket Sales: Down 15% from 2019; However, revenues are up 2% over the 2019 benchmark.

The US presents a mixed picture. While philanthropic gifts are nearing pre-pandemic levels, revenues are still recovering. Interestingly, ticket sales are still 15% lower than in 2019, but there’s a slight increase in revenue, indicating potentially higher ticket prices or a shift in the types of events attracting audiences.

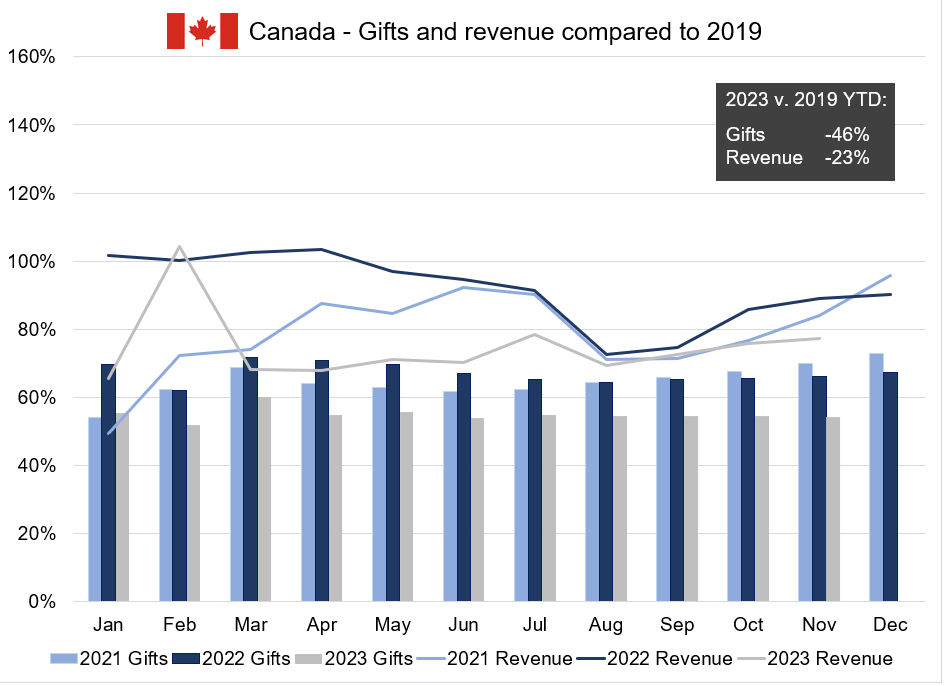

Canada: Decline in Philanthropic Gifts and Ticket Sales:

Philanthropic Gifts: Down 46% from 2019; Revenues down 23%.

Despite a stable trend in gifts and revenues since March of this year, Canada has struggled to surpass the figures from 2021 or 2022 in any given month. This indicates a significant drop from pre-pandemic levels, signaling a cautious approach or potential donor fatigue within the Canadian market.

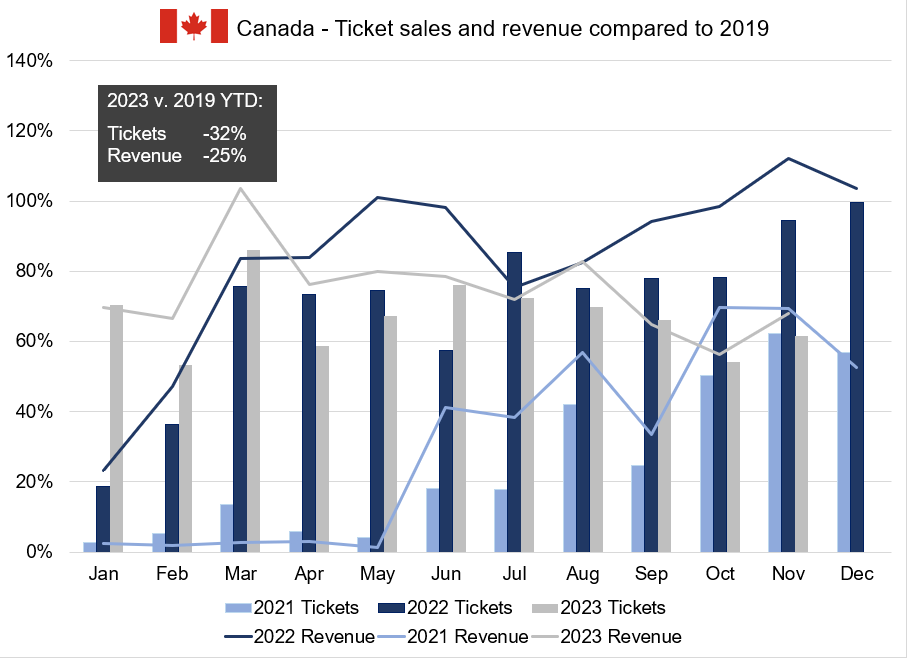

Ticket Sales: 32% drop since 2019; Revenues down 25%.

Canada’s market has experienced not only a significant decrease in philanthropic gifts but also a considerable drop in ticket sales and associated revenues since 2019. The fluctuations throughout the year, coupled with historical trends of revenue dips from November to December in 2021 and 2022, suggest that Canada might end the year on a downward note.

Comparative Analysis

Canada’s Widespread Challenges: The decrease in both philanthropic and ticket sale revenues in Canada suggests broader economic challenges or shifts in consumer and donor confidence and behavior.

US’s Resilience and Adaptation: The US market’s resilience is evident in the slight increase in ticket sale revenues despite lower sales volume. The near recovery in the number of gifts is a positive sign, yet the lagging revenues indicate that while donors are returning, they might be contributing smaller amounts, possibly due to economic uncertainties or changing patterns in philanthropic giving.

UK’s Mixed Philanthropic and Entertainment Landscape: The UK’s remarkable surge in both gifts and revenues is an outlier, indicating a strong and perhaps more resilient philanthropic sector. This could be attributed to various factors, including economic recovery, governmental policies, or a shift in public attitudes towards charitable giving.

Conclusion

The comparison of gift and ticket sales data for November 2023 in the UK, US, and Canada reveals varied trends and recovery patterns post-pandemic. These trends provide valuable insights to leaders in navigating the evolving landscape of philanthropic giving and the broader socio-economic factors at play in these regions.