Gifts & Ticket Sales Revenue Analysis: US, Canada, and UK – October 2023

In October’s Gifts Ticket Sales Analysis, we continue to keep an eye on 2023 numbers relative to 2019 to measure recovery, but we also share a snapsot of how year to date 2023 maps onto the recent years of 2021 and 2022. The most interesting insights from this report are shifts in UK philanthropic realities.

Key Observations:

- Gifts: The UK is seeing opportunities created by pandemic era ticket turn backs to build upon individual giving. US and Canada remain concerning.

- Sales: US poor, UK very poor, Canada especially poor.

UK Gifts and Revenue Beating Pre-Pandemic Numbers!:

In the UK, Tessitura recently published philanthropic data from 24 of the largest UK arts organisations telling the story of significant slackening in philanthropic giving. Their gift revenues were down -25% from 2021 to 2022, for a stinging loss of 30 million pounds. This data did little to succor a sector also facing a cutback from government support. Interestingly, it seems that smaller regional venues are enjoying a notably higher level of audience loyalty as the big national arts organisations, particularly in London, saw the greatest decline in private support while also being the most reliant on subsidies. There is however one thread to hold onto in this concerning trend, which is that these large organizations were able to widen their total base of philanthropic givers during the pandemic as the number of givers grew by 29%, largely due to audience members donating their purchased tickets.

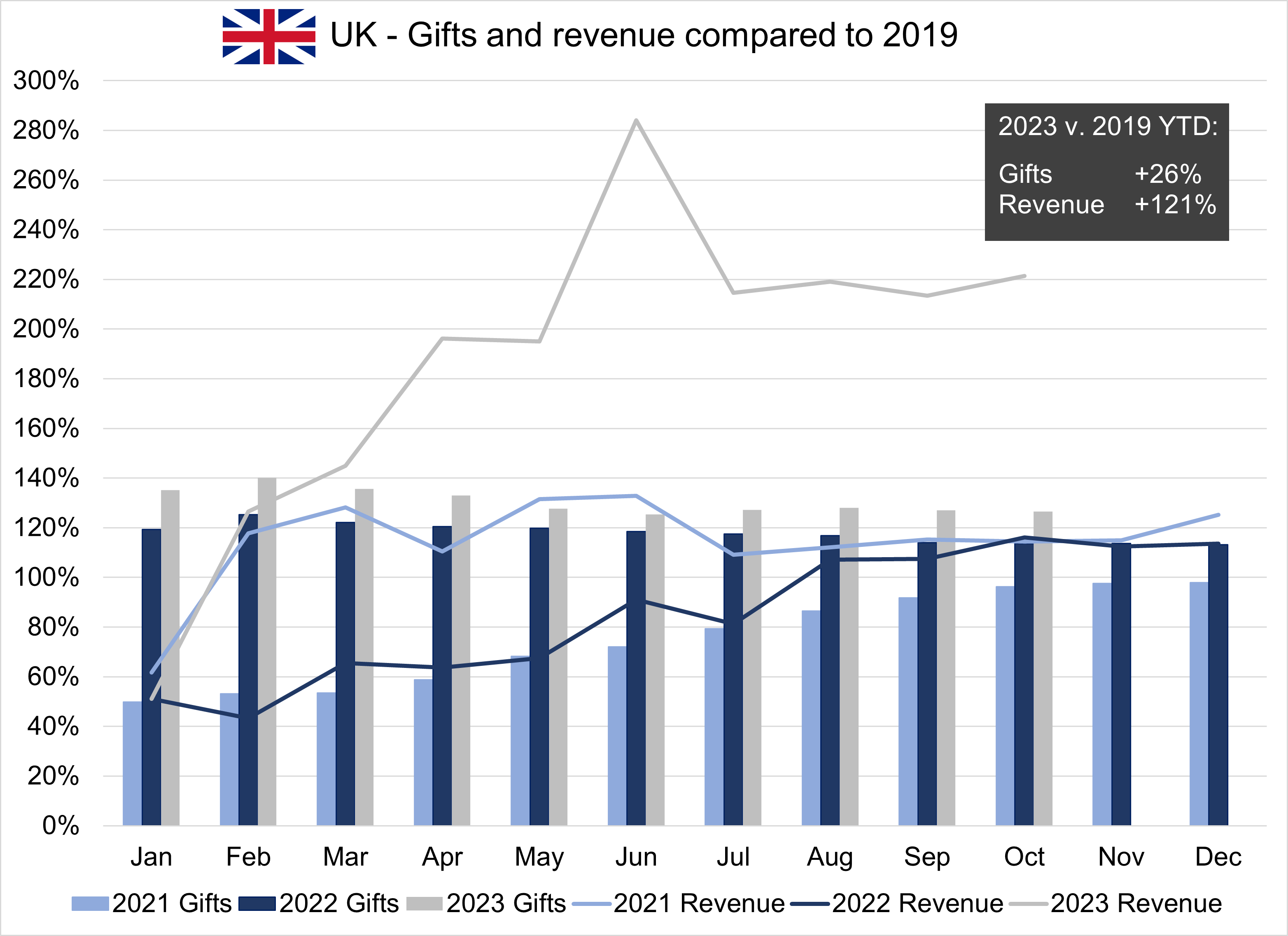

How then is 2023 coming along for UK giving? TRG Arts’ and Data Culture Change have examined recent philanthropic data covering a broader and more diverse section of UK organisations – and the story is much brighter. The first two months of 2023 tracked closely with 2021 in terms of revenue, though the number of gifts was much higher. Peaking in June, the gifts and total revenue well surpassed not only 2021 numbers but even the pre-pandemic strong year of 2019. Year-to-date (October 2023), gifts are up +26% and revenue up +121% over 2019!

The challenge for the UK arts will be to figure out a way to rebuild audience loyalty in the large national venues and how to retain and increase support from the now 550,000+ arts givers. The UK has less of a private philanthropic model than the US, but the ticket turn backs and small gifts made during the pandemic points to opportunities for UK arts organisations going forward to build on audience loyalty and individual giving.

Scaling up the amount of the gifts will be especially important to the large national organisations, as Richard Morrison wrote in the above-mentioned Tessitura report in The Times, commenting pointedly that “If our great arts organisations are to flourish they will need to raise much more money from the private sector. How? Well, if you really want your favourite arts organisation to survive in future, you should be thinking about giving it a three or four-figure donation each year, not the equivalent of a single gin and tonic in the interval bar.” Check out his full commentary here. It seems in 2023, UK arts patrons are starting to take that advice, time will tell if it translates to the largest venues as well.

US Gifts and Especially Revenue are Not Recovered to 2019 levels:

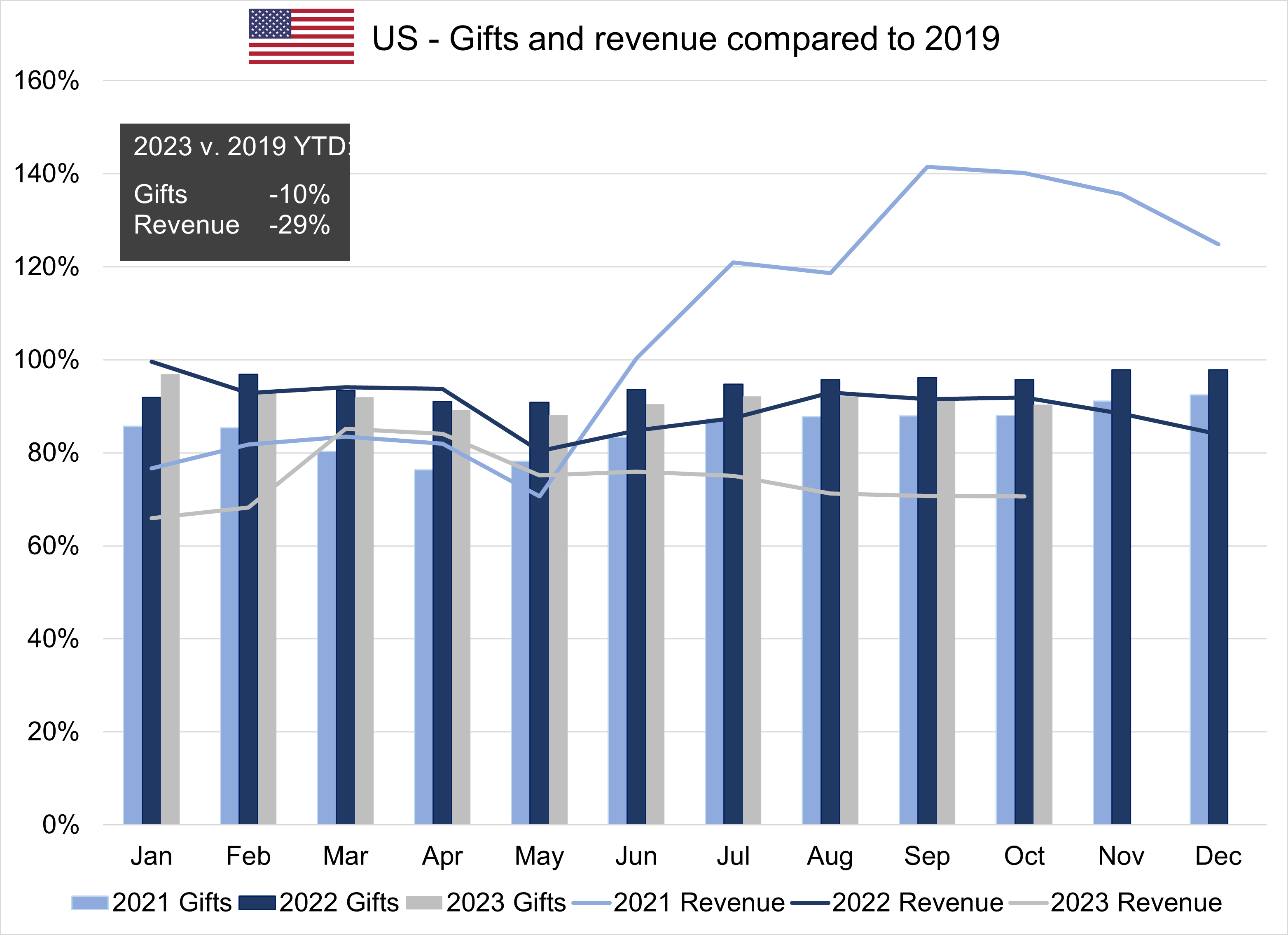

Gift in the US are a less complicated story, 2023 gift numbers and revenues are down from 2019 and even 2021 and 2022. Year-to-date, total gifts are down -10% and -29% in revenues compared to 2019. Numbers were matching 2021 closely until summer, where gifts were not able to keep up with the boost seen from June to October 2021.

Canada Total Number of Gifts Down Significantly from 2019:

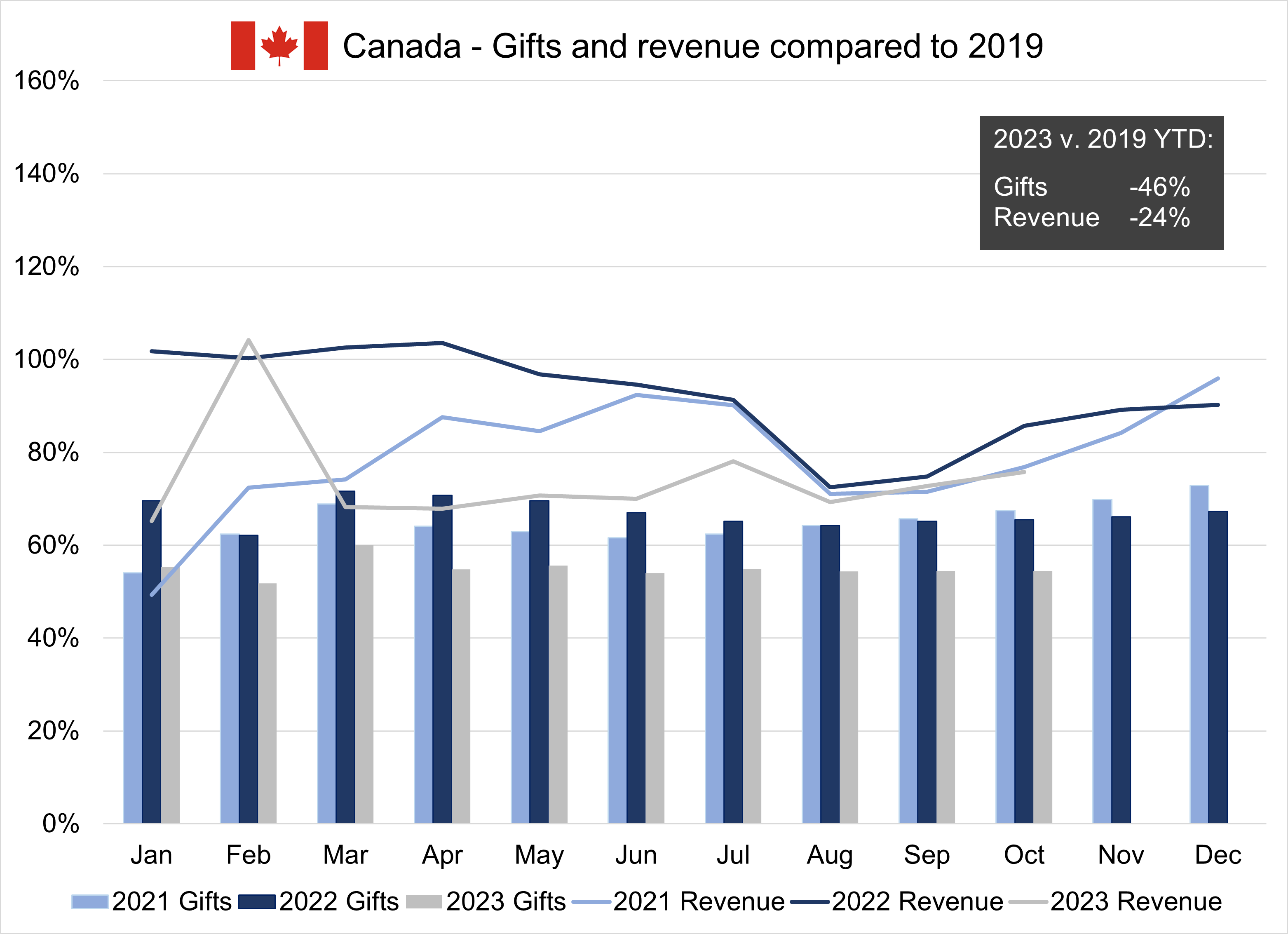

After a promising start to the year, Canada has also not regained pre-pandemic levels of giving. Lagging behind 2021 and 2022 for much of the year to this point, it has started to retrace 2021 revenues, if this continues it might see a nice rise at the end of the year but year-to-date it has fallen -46% in gifts and -24% in revenues from 2019.

UK Tickets Still Stagnating Under Pre-Pandemic Levels:

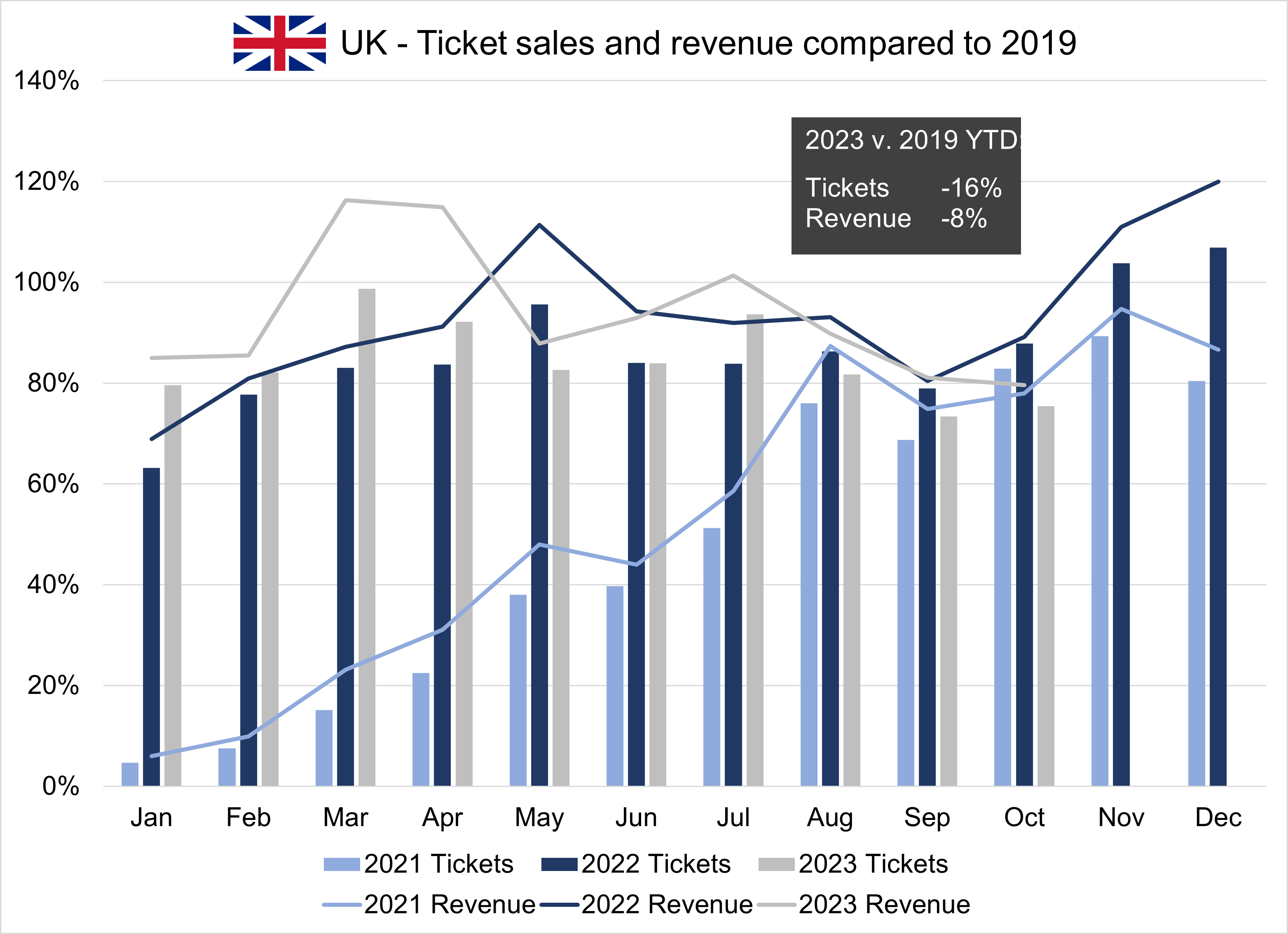

Stagnation has been the theme in UK ticket sales as well in 2023, though it has traced closely to 2022. It is down -16% in tickets and -8% in revenue from 2019, but if ticket revenue continues to follow 2022, it could see a nice surge as we head into year’s end.

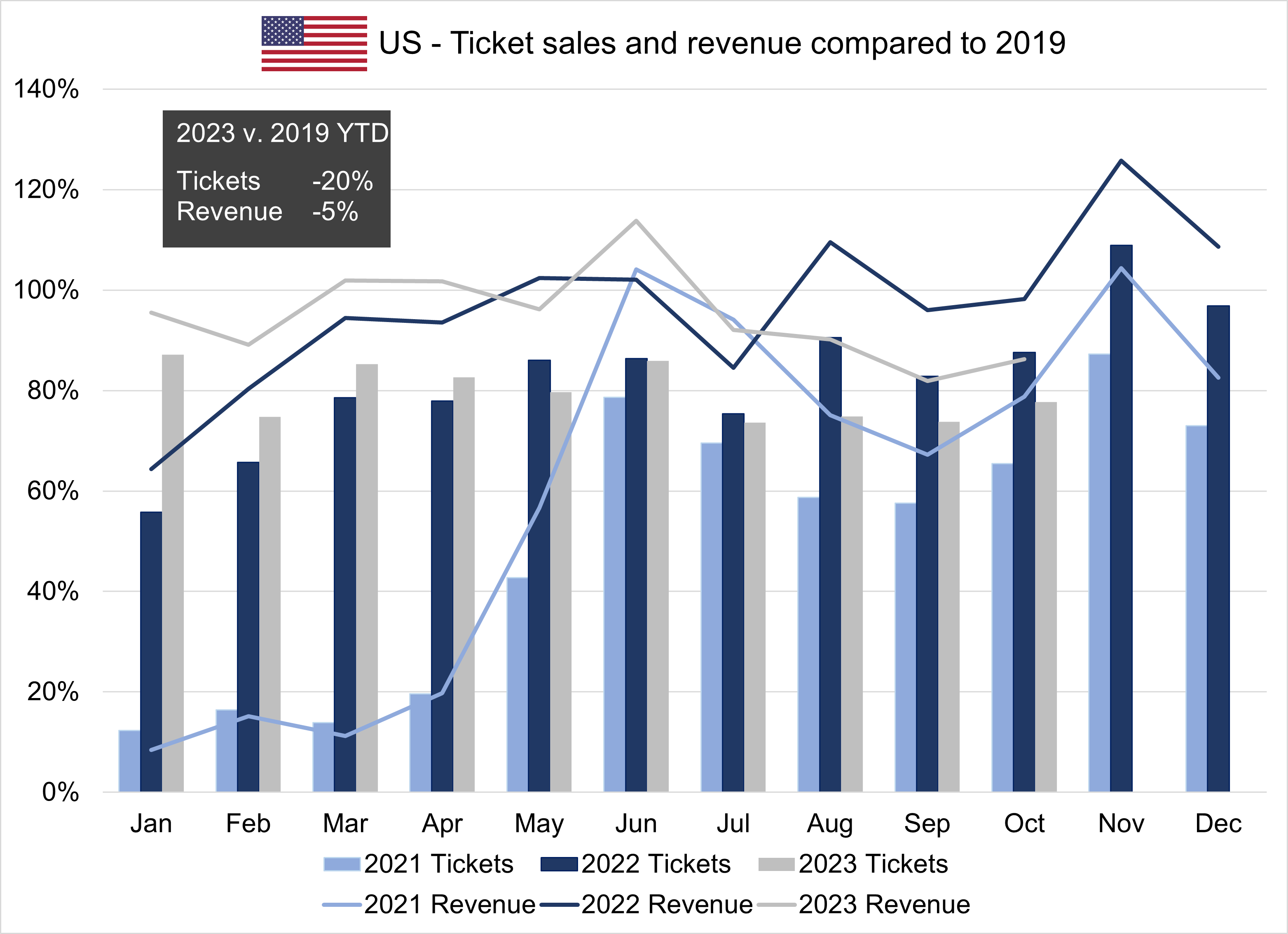

US Ticket Numbers Down Big from 2019 but Revenue Keeping Close:

A relatively stable year for the US in terms of tickets sales, but not fully in a good way. Sales were beating 2022 slightly until July but have since failed to keep up with last year. Year-to-date compared with 2019, the numbers are significantly down in total tickets by -20% but the loss of revenue is modest at only -5%.

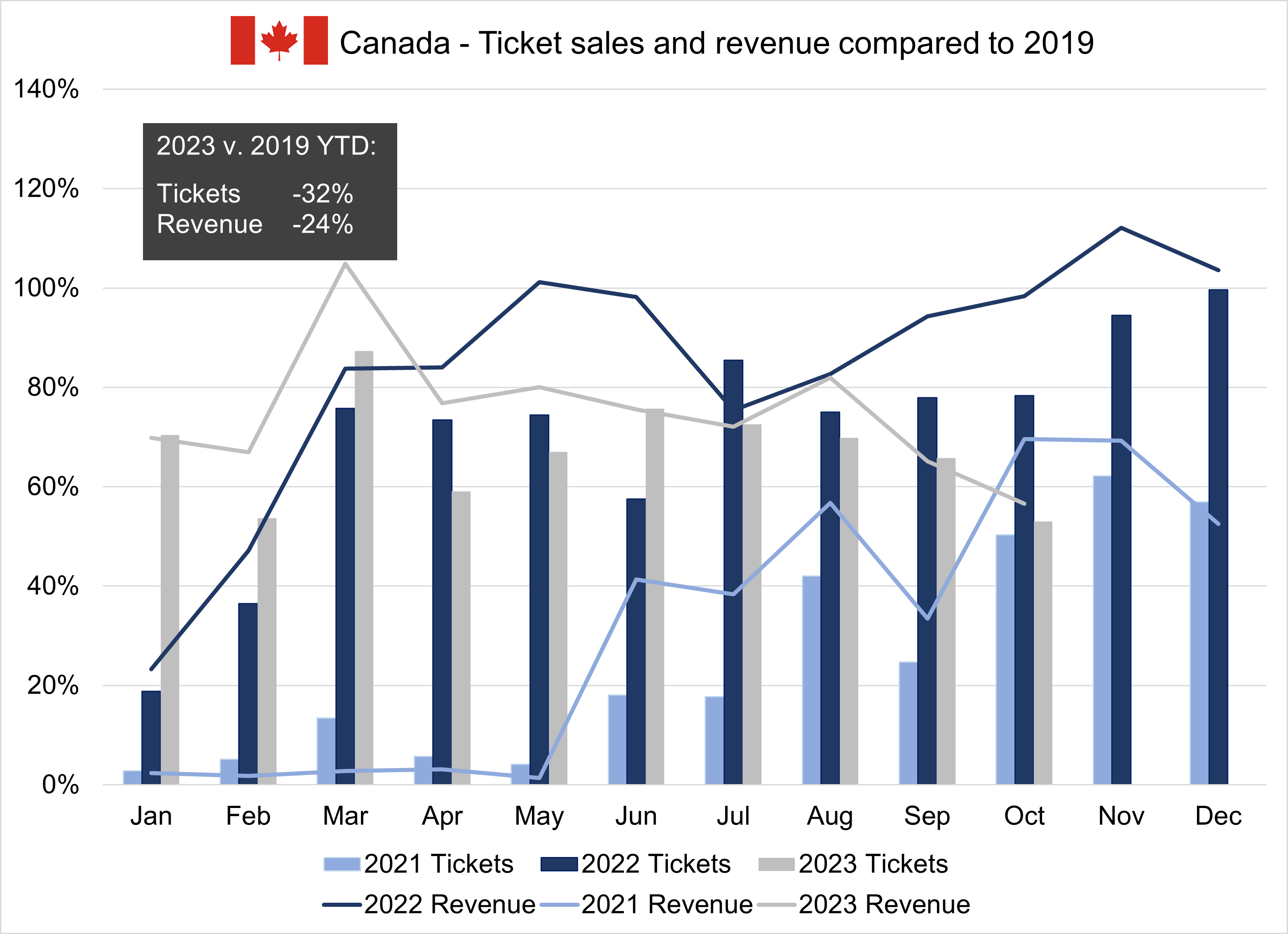

Canada Tickets ad Revenues Down Sharply from 2019:

Spring 2023 was kind enough to Canada, summer stagnated, fall was harsh. Canada’s tickets are down a painful -32% in tickets and -24% in revenue from 2019. This time last year Canadian sales were rising, right now they are falling. Canadian venues will hope for a strong holiday season but discouragingly, both 2021 and 2022 saw drops from November to December.

Conclusion

This analysis underscores the ongoing impact of the pandemic on the arts sector across these regions. The coming months will be crucial in determining whether these trends continue or if new strategies can catalyze a turnaround, especially as we approach the traditionally busy holiday season. The arts sector remains a vital cultural and economic component, and its health is essential for the vibrancy of communities across these nations.